Stories To Watch This Week

🇿🇼 Axia Coporation, 🇿🇦 Multichoice , 🇿🇼 Chicken Inn and KFC

🇿🇼 Axia Corporation Blames Formal Traders

Axia Corporation’s financial results were recently released, and revenue was down 4% driven by a massive 39% drop in volumes in one of its divisions, Distribution Group Africa (DGA), a distributor for brands such as Unilever, Colgate, Nestle and Kellogs’.

Axia blamed this drop on “formal traders” failing to adhere to agreed payment terms thereby limiting their working capital. Who are these formal traders?

The formal traders should be big players for DGA to have a 39% drop in volumes. OK Zimbabwe and TM Pick N Pay come to mind.

However, OK Zimbabwe has been struggling for a while as highlighted in this article here, so for this to be a recent development does this mean TM Pick N Pay is also now struggling to pay on time?

TM Pick N Pay’s financial results will be released soon as part of the Meikles Limited group. It will be worthwhile looking at how well they are performing.

🇿🇦 Motsepe to join in Multichoice bid

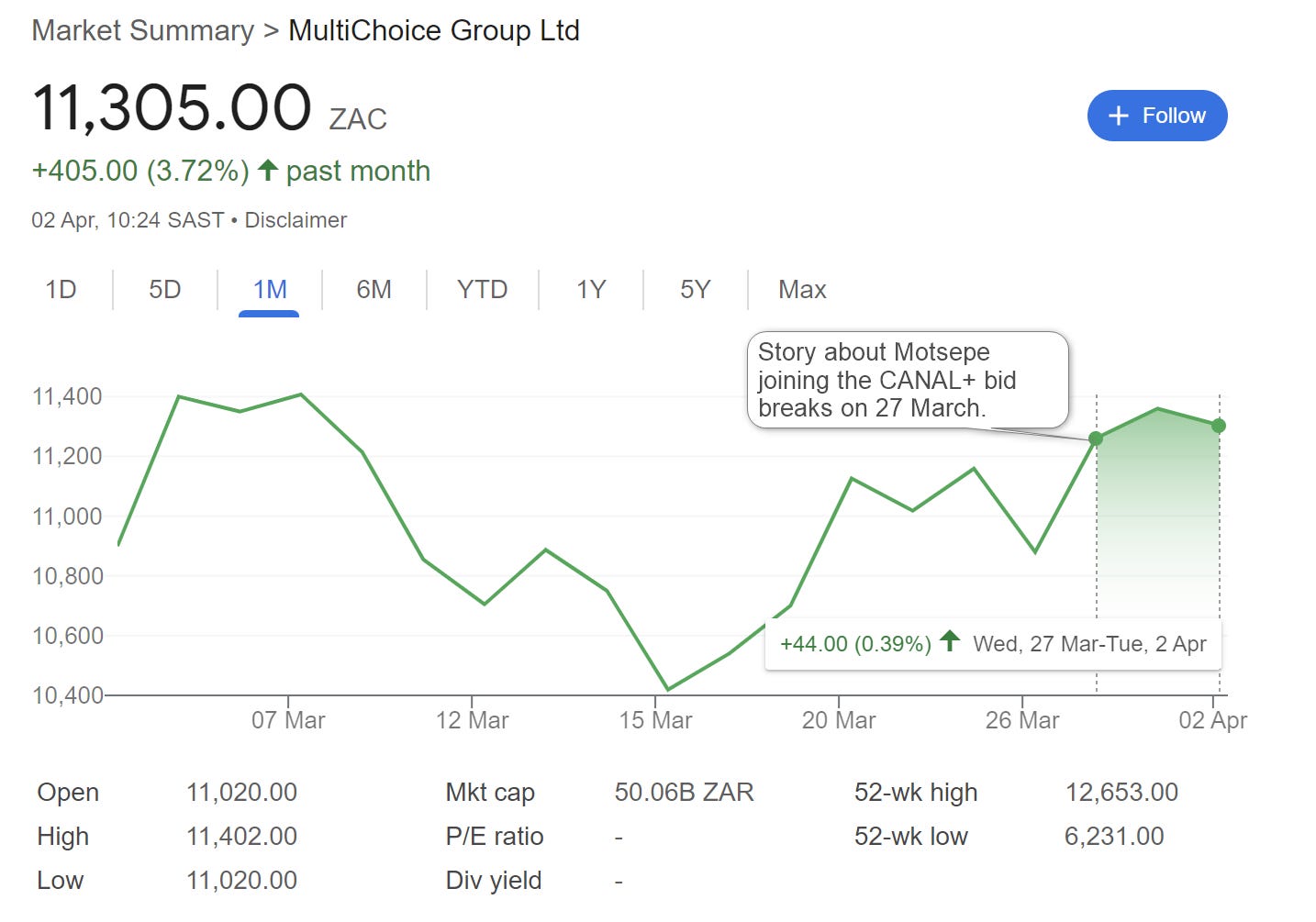

There are reports that South African Billionaire Patrice Motsepe may join in the CANAL+ bid for Multichoice Group.

Despite the news, Multichoices’s share price hasn’t moved much further towards the offer of R125 per share that CANAL+ made.

This means either the market doesn’t believe that Motsepe will join the CANAL+ bid, or the partnership won’t change much in terms of chances that the deal closes.

The odds implied in the share price are that the deal will still close but there is still a lot of uncertainty, especially from a regulatory perspective.

To find out more check out our earlier analysis on the deal here.

🇿🇼 KFC is opening an outlet in Borrowdale Near Chicken Inn

KFC in Zimbabwe is opening an outlet in Borrowdale, Harare near one of Chicken Inn outlets. This marks a significant showdown in the QSR “Chicken War” between KFC and Chicken Inn which has dominated the market for over 30 years.

Borrowdale is one of Zimbabwe's wealthiest suburbs, and both Chicken Inn and KFC will want to win in this profitable area. To understand this battle more check out this article here.

What’s in Store This Week

Tuesday: Stories To Watch This Week ✅

Midweek: Deep Dive Into Econet Wireless⏳

Friday: Chart of the Week - Econet Share Price Development⏳