Stories to Watch: 🇿🇼 TM Pick n Pay's Results

Not yet good but certainly getting better

TM Pick n Pay’s results are not yet good but certainly getting better

Companies mentioned in this post: TM Pick n Pay, Meikles Limited, Simbisa Brands, Pick N Pay Group, OK Zimbabwe.

Last week, I unpacked how Pick n Pay in South Africa is in big trouble, so it was interesting to see how TM Pick n Pay is doing in Zimbabwe.

TM Pick n Pay is 51% owned by Meikles Limited and 49% owned by JSE-listed Pick n Pay. Since the demerger of Tanganda and the sale of Meikles Hotel, TM Pick n Pay has made up more than 98% of Meikles Limited’s revenue.

Meikles Limited recently released its results, which break out TM Pick N Pay.

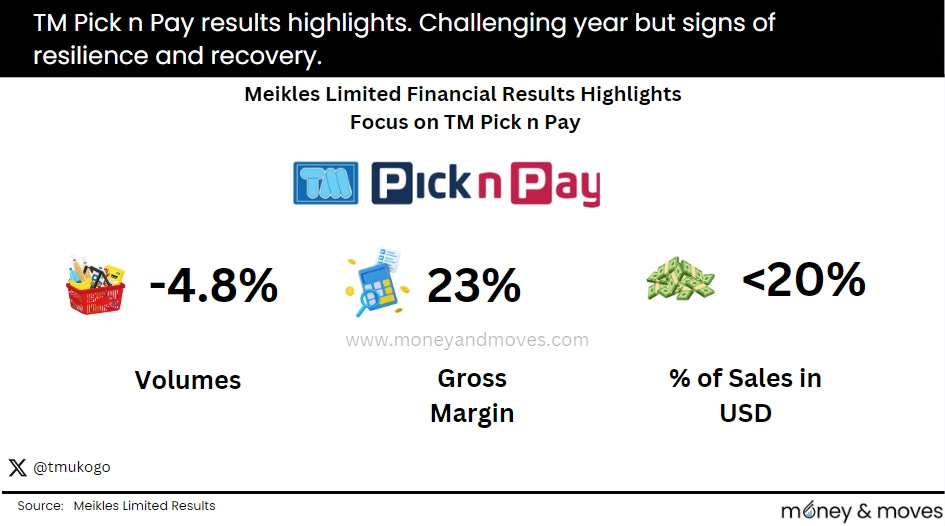

The results of TM Pick n Pay were not great but showed signs of resilience and recovery. The business is also performing better than its peer, OK Zimbabwe.

Volumes sold reduced by 4.8% compared to last year, which is a concern. The good news, however, is there was a significant improvement in the second half of the year, which saw growth of about 5%.

For comparison, OK Zimbabwe’s volumes were down 28% for the nine months ended December 2023. These results seem to confirm the analysis I performed several months back, which showed TM Pick n Pay was performing better than OK Zimbabwe.

Below is one data point from that analysis. I ran a poll that received 2,535 votes and indicated that 76.1% of people preferred TM Pick n Pay over OK Zimbabwe.

TM Pick n Pay is still struggling to collect USD, with less than 20% of sales being made in hard currency. This is far lower than the national average, which is now about 80%, with some companies, such as Simbisa Brands, reporting amounts as high as 84%.

Despite this, companies like Meikles Limited could be attractive investment opportunities.

Should dollarisation take place fully or the ZiG manage to hold value, improvement could occur quickly, with an equally rapid uptick in unlocked value.

This has already happened partly, with the share price up over 200% since the ZiG was introduced, which has held value in one way or another.

PS: I am working with publicly available information, so my analysis could be missing something or just wrong.

Thanks for reading. Let me know what you think. Please share this post with your network via LinkedIn, WhatsApp, email or whatever platform you prefer.