The Overlooked Truth Smart Investors Miss About Stocks and Property

Markets are driven by attention and not just value. Here’s why that matters.

Last week, Matt Levine reminded me of one of the most essential realities about stocks and investments.

"Stocks go up because people buy them."

If this seems too simple and obvious, you may be underestimating one of the most subtle but important truths that can cost you millions when making investments in stocks or even property.

Why Stocks Go Up

To begin, I need to quote Matt Levine directly and then provide further explanation.

Here's the direct quote from his article:

"An important discovery of our meme-stock-and-crypto age is that stocks go up because people buy them. It's more of a rediscovery. But there was a long period when people thought that stocks go up for reasons like 'good earnings' or 'increasing present value of expected cash flows' or 'increasing capacity to pay dividends.'"

When someone analyses a stock based on its earnings and cash flows and realises it's worth $100 but is currently trading at $50, they see an investment opportunity. The assumption is that because it's undervalued, the stock price will eventually go to $100.

Logically, this makes sense. But in reality, if the stock goes up to $100, it's not inherently because the stock was undervalued—it's because more people bought the stock.

It's possible people bought the stock because it was undervalued, but it's also possible they bought it because they just liked it for whatever other reason.

The best example of this is meme stocks, like GameStop.

A meme stock is any publicly traded stock with a price performance that’s strongly influenced by activity on social media

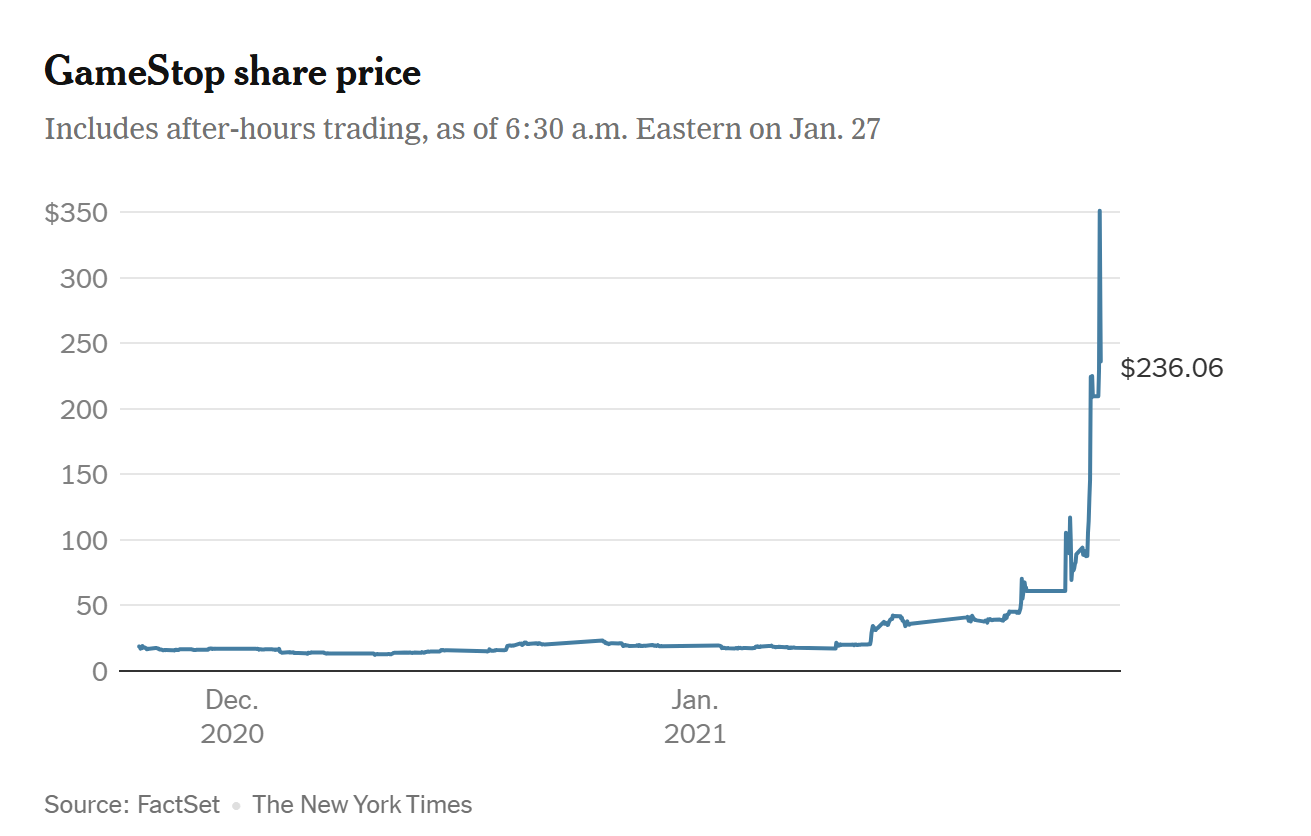

GameStop shot to fame in 2021 when the stock rallied over 1,000% in a few days. If you had bought GameStop around this time in 2020 and sold during the January 2021 rally, you could have made 100 times your money.

Now, for sure, there was a case to be made that Gamestop was undervalued. But not 100 times undervalued. The reason GameStop went up so much was because people bought the stock.

Why did they buy the stock? It was fun, it was cool, it was hyped, so they bough the stock.

How This Impacts the Stock Exchange

The flip side of this idea is that if people don't buy stock, the price will remain the same or even drop—even if the shares are undervalued. When you look at several stocks on the ZSE and VFEX, this is exactly what's happening.

From the data I've reviewed on listed companies in Zimbabwe, many top companies are undervalued by as much as 100 - 150%. Despite this, people aren't buying, so share prices haven't moved.

Many of the reasons people aren't buying likely stem from general scepticism and inherent concerns about the country, and more specifically about the stock market.

As we discussed before, when we looked at the Stock Market vs Property debate, the stock exchange hasn't always managed to create capital growth. In 2015, the combined market cap of the ZSE/VFEX was around $3.8 billion; nearly a decade later, it is still roughly the same.

The concern is that even with undervalued companies, prices could stay depressed for a long time because people aren't interested in buying due to negative perceptions.

The opposite, however, is true for property. While people don't like stocks in Zimbabwe, they really like property.

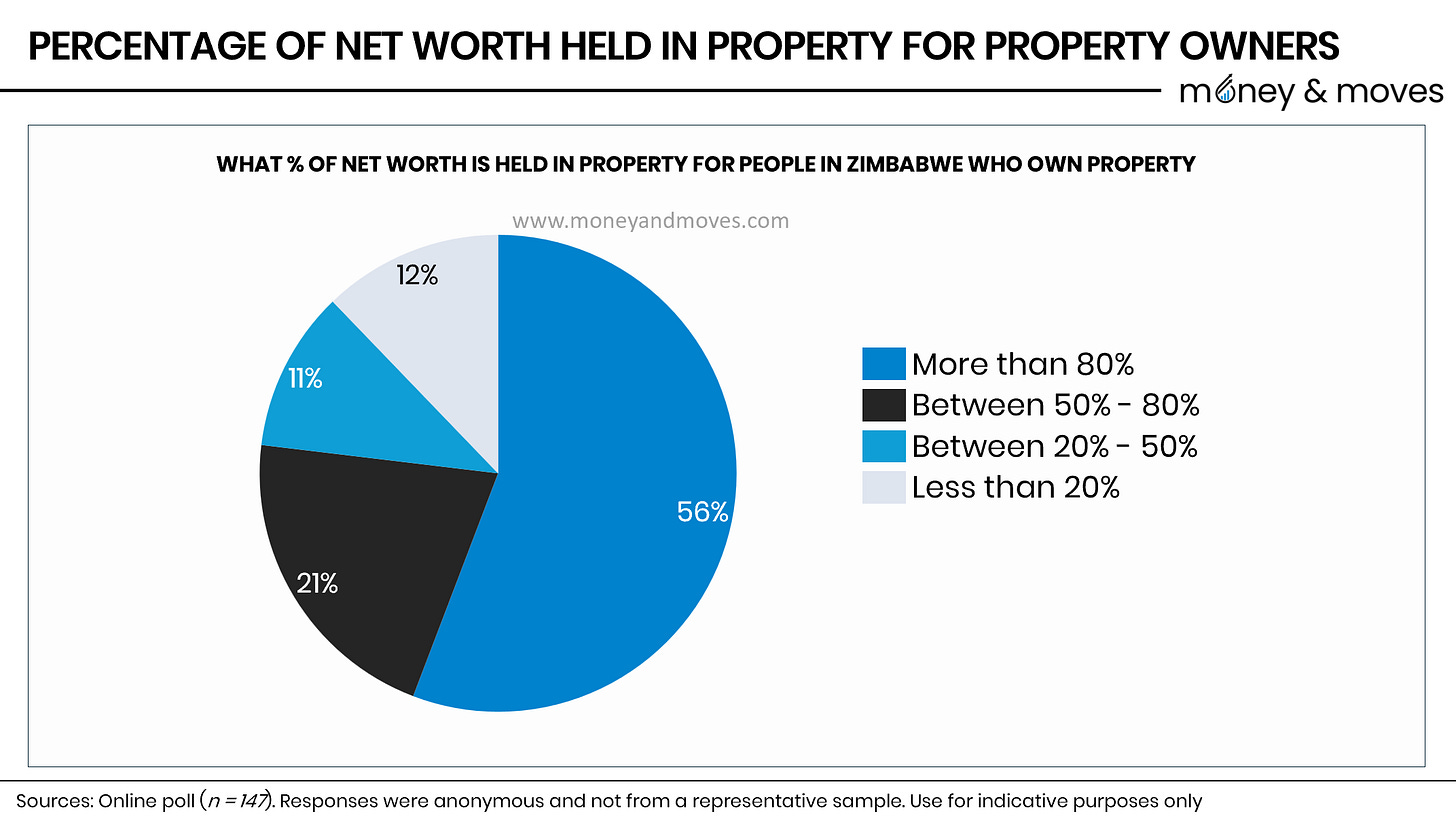

Based on an online poll, more than half of property owners have 80% of their net worth tied up in property.

This means that even if the economics in the property market are starting to show cracks—as we've highlighted before—valuations can still keep going up because people keep buying property.

This could explain in part something we talked about last month — rising property valuations while rental yields are low.

Where's the Money? What’s the Move?

No one can time the market (predict when it will change), but understanding the market can help you time your moves.

For example, although many stocks in Zimbabwe are undervalued, that doesn't mean that if you invest today, you'll get a quick return.

Until there's a catalyst that makes people want to buy again, stocks can remain at low prices for extended periods. This is why it's important to have a long-term outlook.

When that catalyst comes, there will be a price increase that will likely be very quick and aggressive.

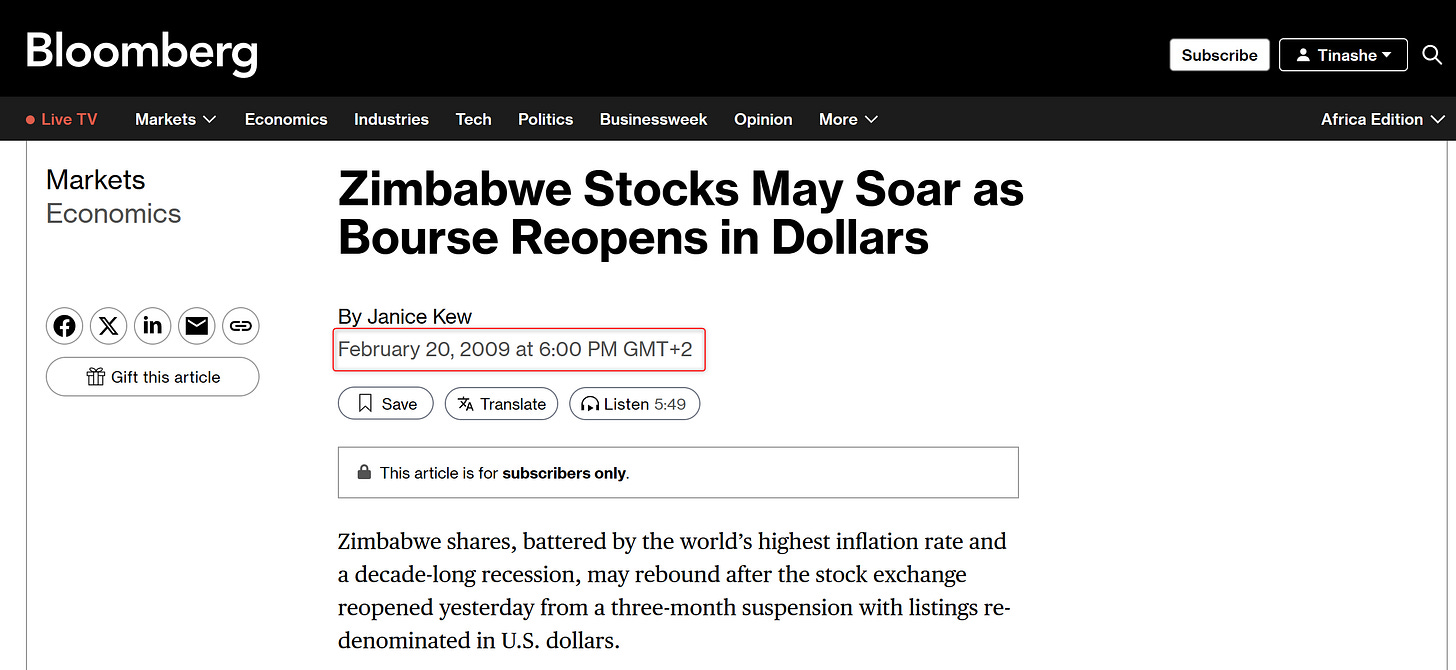

An example of this was in 2009 when the economy dollarised and a Government of National Unity was formed—within a year, the stock market tripled from its opening values.

On the other hand, this also means you shouldn't presume the property boom is going to slow overnight. People like property, so many people will buy property, thereby keeping values increasing even if the unit economics are no longer attractive.

As short sellers are often cautioned:

“Markets can remain irrational longer than you can remain solvent.”―John Maynard Keynes

If you're an executive who cares about your stock price, developing a compelling story for your company and communicating effectively can be key.

If your company is undervalued, finding ways to make people "like your stock more" may be a more effective way to increase shareholder value than actually improving performance.

As someone who's more driven by analysis and fundamentals, this often doesn’t seem right. But you also can't fight against the market.

Stocks go up because people buy them.

Thanks for reading. If you found this interesting, please share it with your network. If you haven't subscribed, please consider signing up to never miss a post.

PS: The above is not investment advice and is for educational or informational purposes only.

Can we say marketing influences the price per share of a stock?

Eventually better stocks will go even higher